Home › EIDA Forum › Today’s Discussion and Announcements › Coronavirus – Our Industry and Supply Chain

- This topic has 0 replies, 1 voice, and was last updated 6 years ago by

Tingting Zhang.

-

AuthorPosts

-

-

at #3525

Tingting Zhang

KeymasterThe measures to control the spread of the virus and the behaviour of people in response to this threat are bound to have a significant short term impact. The medium and long term impact is a matter of speculation amid many unknowns. Leading Adelaide electronics firm Don Alan Pty Ltd surveys the current situation.

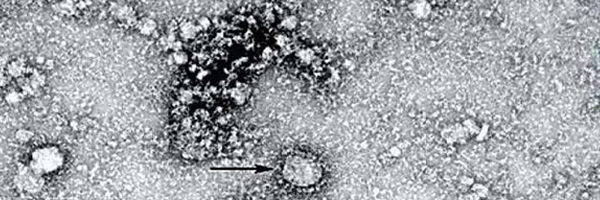

China’s National Microbiology Data Center shows the first-ever specimen of ‘2019-nCov’, extracted from a patient

The regularly schedule Chinese New Year holiday that would have finished on Jan 30th had delayed the awareness about the likely impact but as the return to work date has been stretched out importers have been confronted with the realization that substantial uncertainty remains. We are not going to pretend that we can provide much guidance on how the Novel Coronavirus emergence will pan out long term. This update is to draw your attention to the impact that it may have on supply chain for electronic components, assemblies and products.

Impact of Novel Coronavirus (2019-nCoV)

The direct impact of this virus on supply chain to date and over short term (8 to 12 weeks) is likely to be small. While infections in the thousands and fatalities in the hundreds is tragic it is not demographically significant.

We do not pretend that we can provide much guidance on how the Novel Coronavirus emergence will pan out long term. This update is to draw your attention to the impact that it may have on supply chain for electronic components, assemblies and products.

Restrictions on Movement in China

There are currently sixteen cities with a population of about 50 million people where people leaving is greatly restricted. Some provision is available for incoming freight and supplies.

The impact on transport logistics for manufactured items has been masked by the national holiday for Chinese New Year (CNY). Last shipments prior to the CNY holiday were in train before the movement restrictions. CNY Holidays were due to end on the 30th of January but that has been postponed. Many importers from China wont have had updates as their suppliers are still on CNY holidays. Each province sets its own return to work day. Mostly this is currently the 10th. But it would be surprising if this was not extended. Wuhan is scheduled to go back to work on the 13th but given the additional measures for infection control implemented today that seems unlikely.

Even once a factory is allowed to resume work it may not have the required staff. Normal CNY holidays represent a time of high staff transition as workers change jobs. Many manufacturing staff will have returned home and, more than in most years, may choose to stay home even if movement restrictions do not prohibit their return to work. Even for those who do return to work they are now required to ‘stay home’ for 2 weeks after returning in self quarantine.

The CNY holiday has postponed the consideration of the economic impact of the choices made to contain the impact of the virus – from an overall long term perspective that may well be beneficial for minimising the impact of the virus but we will leave that for epidemiologists to comment. Freight will presumably be available or made available for medical and food items. Your finished products and the upstream materials required to make them are likely to be well down the list of priorities in the current situation.

Significantly major freight carriers have revealed little about impacts on freight movement.

The disruption of the export manufacturing segment is unlikely to have the same gravitas as it may have had even 5 years ago. The push for China’s economy to be driven more by domestic demand has reduced the prominence of this sector. Fortunately for those that rely on the export manufacturing segment of China, many of the considerations are common to both domestic and export manufacture.

Short Term Outlook and Tactics (Generalised)

I use the term tactics and not strategy. If there were a strategy to deal with this it would need to be already in place (ie supply chain geographic diversity).

If you were expecting product to ship from China in February or March it may be wise to be highly doubtful about timely delivery. It may be possible to have items manufactured elsewhere if the product is simple to move from one factory to another (bare PCB and simple wiring looms for example).

Needless to say – close communication with vendors is essential – but any sense of certainty they provide may be more aspirational than factual given the uncertainty they face. It would be wise to keep in mind that they are experiencing the situation as a business challenge and directly in their own life and the lives of their family.

In this time frame issues around source material shortages are likely to be minimal (excepting for hoarding behavior) as production on this time frame is drawing on currently existing materials.

Medium and Long Term Strategy (Generalised)

The uncertainty over the longer time scale is more uncertain. It is our opinion (and nothing more factual than that) that over the medium and longer term the impact of the virus will likely be more in line with its real direct impact. Economic imperatives and the need to live will free up freight and factories will have access to workers needing income. This assumes of course that impact of the virus is not so great that the general fabric of the economy falls into disarray (we see nothing to suggest this). It is also not to say that the real direct impact will not be significant.

Many importers must be tempted to adopt an immediate plan towards geographical supply chain diversity. There are some very substantial barriers to this though. At the first level there is the loss of economies of scale of concentrating your manufacturing when it is split between countries. When confronted with the possibility of having no supply the increased cost of diversification may seem a worthwhile compromise.

Unfortunately the next challenge is more problematic. It is very hard to be geographically diverse at all points in the supply chain. While you may order from multiple factories in multiple locations and their suppliers may be local to them, many of the raw materials end up coming from China. Such is the diversity and completeness of the China supply chain. Even if geographic diversity is not possible at all points in the supply chain we believe you can build some resilience against short term issues this way.

Further more – even if both of these issues (increased cost and single origin raw materials) are overcome there is no certainty that the impact of the virus will not become as geographically diverse as your supply chain. The preparedness of any alternate manufacturing location to deal with this or other emerging threats should be considered.

Editor: This survey of the Coronavirus situation has been provided to customers and associates of Don Alan Pty Ltd and is reproduced here to alert other industry participants to the problem as it is currently understood.

-

This topic was modified 6 years ago by

Tingting Zhang.

-

This topic was modified 6 years ago by

Donald Kay.

-

This topic was modified 2 years, 6 months ago by

Tingting Zhang.

-

This topic was modified 6 years ago by

-

-

AuthorPosts

- You must be logged in to reply to this topic.