Home › EIDA Forum › Today’s Discussion and Announcements › Failing banks and mass layoffs: Is the 15-year tech boom over? And, what went wrong?

- This topic is empty.

-

AuthorPosts

-

-

at #5430

Tingting Zhang

KeymasterA generation of bright young Australians made their way to California, pursuing their fortunes, but also propelled by optimism that tech was making the world a better place.

When Brendan Gregg moved to Silicon Valley in 2006 as a young Australian software engineer, Apple was building its first iPhone, Google was still rolling out Google Maps and Uber did not exist.

The global financial crisis of 2008 was followed by a 15-year tech boom that introduced the world to smartphones, apps and now-common terms like “selfie”, “viral” and “emoji”.

Brendan Gregg is the creator of many open source performance analysis tools.”The company was so small we could fit into a single movie theatre,” he said.

Many years later, the long boom has now ended, not with an overnight crash but with a months-long decline, rounds of mass layoffs, and a recent series of high-profile bank collapses.

But even before this, the dream had soured as fake news scandals followed revelations of election hacking.

Google, the great disruptor, became a monolithic bureaucracy. Facebook, mired in the misinformation problem, poured billions into an unpopular metaverse idea.

“The world has changed. The US is a darker place and Australia is a brighter place for tech,” Mr Gregg said, who has moved back to Sydney.

“The circumstances that led me to go to the US and led others to go to the US many years ago doesn’t exist.”

So, what went wrong in Silicon Valley?

As the layoffs continue, the story that’s emerging is an old and familiar one. A cluster of companies that changed the world through innovation have run out of successful new ideas.

For years, we’ve been told that Silicon Valley is a place of “magic”, where the “future is invented”.

Now, the magicians appear to have lost their magic. The future hasn’t worked out as they had intended.

The unravelling of the future

To get a sense of the mood among tech workers, one place to look is the anonymous workplace forum Blind, where software engineers trade stories.

Why the collapse of SVB is having a ‘contagion effect’

The SVB collapse didn’t just leave the banking sector in disarray; technology startups are bracing for a harder time, and there are fears the global economy is at risk of recession.

This week, one story struck a nerve. An engineer had told his barber he worked in tech, and, instead of the usual admiration, received words of sympathy.

“Apparently tech workers are now known for being insecure and overworked,” he wrote.

“Gone are the days that engineers are respected”

Someone replied that the same thing had happened with an Uber driver.

In another post, an ex-Amazon engineer described sending out dozens of resumes and receiving no response.

The crash kicked off around October 2022, the week the world’s biggest tech companies reported their latest earnings.

The news was bad. Meta, Alphabet and Microsoft saw billions wiped off their value.

In November, the third-largest cryptocurrency exchange by volume, FTX, collapsed in spectacular fashion over the course of a week.

On top of this, interest rates were going up. By Christmas, they were at their highest in 15 years.

Meta fired 11,000 employees. Amazon 10,000. Through the New Year, the redundancies continued. One round of layoffs rolled into another. Meta let go another 10,000. Amazon followed with 9,000 more.

By late March 2023, tech companies had laid off an estimated 290,000 workers, mostly in the US.

How SVB collapse is hitting the tech start-up ecosystem(Nassim Khadem)

Then, to cap it off, Silicon Valley Bank abruptly collapsed, triggering the most significant financial crisis since 2008.

“If the fall of Silicon Valley Bank had happened in isolation, it would be one kind of story,” Margaret O’Mara, a tech historian at the University of Washington, said.

“But the fact that it’s happening as these big layoffs are happening and as you’ve had these scandalous collapses of crypto … it all becomes part of a bigger story … we’re downshifting now to something different.”

Why now?

For Professor O’Mara, author of, The Code: Silicon Valley and the Remaking of America, the bursting of the tech bubble didn’t come as a shock. The surprise was that it had taken so long.

“I was sort of waiting for the bubble to burst year after year after year after year,” she said.

“And it didn’t, and it was really extraordinary.”

Dropbox’s 2018 IPO in the heyday of the Silicon Valley tech boom.(Getty Images: Drew Angerer)

David Karpf, an author and researcher of digital media at George Washington University, made a similar observation.

For years, he said, the tech bubble was expected to burst. Yet, somehow, the bubble expanded. A frenzy for boutique cryptocurrencies gave way to an equally baseless speculation in non-fungible tokens (NFTs).

“There was an awful lot of people, including myself, staring at it, saying, ‘This can’t go on forever’,” he said.

“So 2022 was partially the year when those things didn’t go on forever.”

What changed? In the short-term, interest rates.

“When interest rates go up, investing long-term in the future isn’t free anymore,” Dr Karpf said.

That is, private capital funds withdrew their support for risky start-ups promising to change the world, and went looking for safer, more conventional investment options.

For the companies not relying on venture capital, interest rate rises meant lower consumer spending, which hurt their sales, including revenue from advertising.

Alphabet (Google’s parent company) made billions less in advertising in the final quarter of 2022 compared to a year earlier.

It was only the second time its quarterly ad revenue had contracted in its 26-year history.

This was significant because despite its mantra of innovation, Google’s business model hadn’t changed: It still made most of its money from search ads.

Start-ups become the status quo

There’s another, deeper explanation for the downturn, one that goes beyond interest rates and macro-economics.

The innovations that have powered Silicon Valley’s success, from smartphones to ride-sharing apps, are now at least 10 to 15 years old.

Google co-founder Sergey Brin, and designers Diane Von Furstenberg and Yvan Mispelaere, modelling Google Glass wearable tech, walk the runway at a 2012 fashion show.(Getty Images: Frazer Harrison)

The newer products haven’t caught on, at least not at the same scale. Google retired Google Glass in 2015. Facebook quietly pivoted away from its vision of the metaverse as a mainstream application of virtual reality. Self-driving cars are stuck in the slow lane.

The future that was predicted failed to happen.

“It’s not that Silicon Valley stopped coming out with new things. It’s that those new things stopped catching on,” Dr Karpf said.

Big tech has generally run out of successful new ideas.

Meta spent more than $US15 billion on its metaverse venture, but couldn’t get enough people to log on.(Supplied: Meta)

Generative artificial intelligence, such as OpenAI’s ChatGPT, is an example of this. Despite having the advantage of time and resources, Google got beaten by the OpenAI. Founded as a non-profit in 2015, the start-up had only 100 employees as recently as 2019.

In part, stagnation was inevitable, part of the life cycle of companies, said Professor O’Mara. The start-ups have become the status quo, with a financial interest in not innovating.

You become extremely successful and it becomes really hard to be as successful in whatever the next thing is.

“In order to really innovate, you have to turn from the thing you’re doing.”

An opportunity for Australia?

Like Mr Gregg, Kate Kendall is an Australian who’s worked in Silicon Valley and come back home. This is so common, people like her have a special name: Boomerangs.

While in California, she helped set up a network of Australians in Silicon Valley called the Aussie Founders Network.

Apple’s Silicon Valley headquarters, named Apple Park.(Unsplash: Carles Rabada)

She returned to Melbourne in 2017 and now runs the Atto Accelerator program to help female founders launch tech companies.

Silicon Valley remained important, but was no longer the sole destination for wannabe founders, she said.

“We’ll never see Silicon Valley be the hub that it has been over the last two decades.”

One reason for this shift has been Silicon Valley’s own success. Cost of living there is high. With the option of working remotely, the Valley no longer exerts the same gravitational pull.

/We can work for global tech companies while based in regional Victoria, which wouldn’t have been the case a few years ago.

“You can create a global success story out of Australia.”

Other countries have also developed their own centres of tech entrepreneurship, modelled on Silicon Valley, Professor O’Mara said.

“America’s advantage has long been attracting all the smart people from all over the world to come here.

“What’s emerged over the long tech boom is serious start-up clusters that are pretty self-sufficient and distinctive all over the world.”

Australia’s tech sector has also grown, partly due to companies like Google opening offices, but also thanks to homegrown successes, like Canva and Atlassian.

Canva CEO and co-founder Melanie Perkins has been an inspiration for many young Australian entrepreneurs.(Supplied: Canva)

The number of tech workers in Australia grew almost 50 per cent from 2014 to 2021, according to the Australian Computer Society’s (ACS) annual surveys of worker numbers.

“What I see for Australia is an incredible opportunity as a result of what’s going on in Silicon Valley,” ACS CEO Chris Vein said.

“Those people in the tech sector who are being laid off are amazingly talented people and we in Australia need people … we have a chronic skills shortage.

“If we’re smart about it, we can actually leverage this crisis.”

Barney Tan, head of the school of information systems at UNSW, agreed that the pendulum appears to have temporarily shifted away from Silicon Valley.

“What we’re seeing now is a period of readjustment.”

Ultimately, the fortunes of Silicon Valley, or its rivals, rests on its access to venture capital.

The Valley still dominates venture capital funding for start-ups, but its lead has eroded. It now claims about a fifth of total venture capital deals in the US, down from a quarter 10 years ago.

“The start-up will always gravitate to where the money is,” Professor Tan said.

“It will be interesting to see if and when the economy picks up, if the money will still be there in Silicon Valley.”

‘The halo of inevitability’

Despite the layoffs and bank collapses, Silicon Valley remains powerful as the world’s pre-eminent centre for tech.

Some of the redundancies can be attributed to the big tech companies overhiring during the pandemic. Even after two rounds of layoffs, Meta employs more than it did three years earlier.

“It’s not over, but it’s just changing,” Professor O’Mara said.

‘It’s still very significant and not going to crash and disappear.”

Dr Karpf agreed: “I don’t think this is going to be the end of Silicon Valley as a centre of power.

“I think what we’re seeing over this past year is that these companies are going to stay big, but they are no longer being viewed as special.”

This “special” status of Silicon Valley is partly what made the place successful. The tech companies claimed they were inventing the future, that they knew what was coming next.

And for many years, they appeared to be right. This created what Dr Karpf called “a halo of inevitability”.

As a result, venture capital flowed. The recent downturn has punctured that myth.

“They’ve lost that air of invincibility and of knowing what’s coming because they are the future,” Dr Karpf said.

“Instead, they’re looking like people who are making it up, the same as the rest of us.”

By: James Purtill, ABC Science

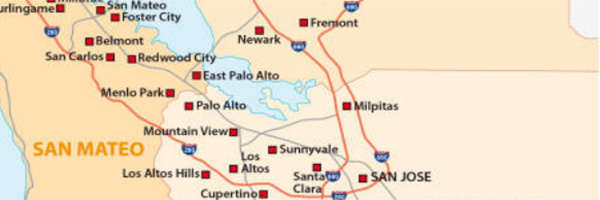

EIDA Ed: On one of my first visits to the ‘Valley’ in the early 1980’s, Sunnyvale, Mountain View, Los Altos, Cupertino and Santa Clara were still service towns for the fruit orchards and the mixed horticultural district known for years as The Valley of Hart’s Delight. The name Silicon Valley was first used in print by technology journalist Don Hoefler in 1971. Palo Alto was always different and since 1885 Stanford University and later its spin-out companies gradually transformed this pleasant little town. The County Seat of ‘Santa Clara County’, San Jose at the southern end of the valley was the valley’s fruit and vegetable canning centre from the 1870’s. Little evidence of San Jose’s agricultural, horticultural and industrial past has survived the ‘Technology Revolution’.

-

-

AuthorPosts

- You must be logged in to reply to this topic.